Introduction

Investing can seem like a daunting endeavor, especially for beginners. The complexity of markets, fluctuating returns, and the variety of investment options available can make it challenging to navigate. However, one of the most important aspects of investing is understanding risk because, in the world of investing, risk and reward are intricately linked. But how do you balance risk and reward to achieve financial goals without jeopardizing your hard-earned money? The answer lies in building a balanced portfolio.

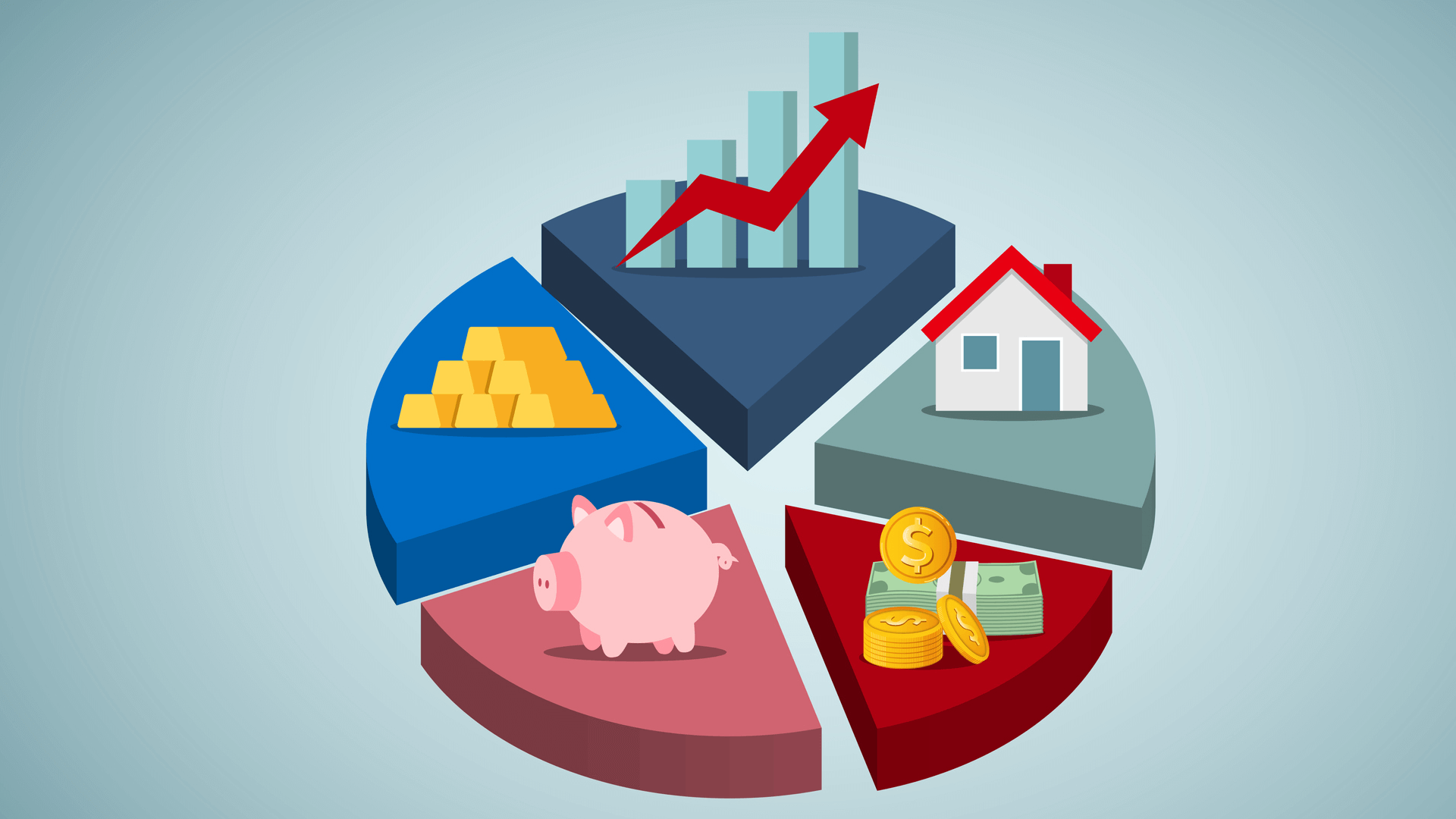

A balanced portfolio is a well-thought-out mix of different asset classes, such as stocks, bonds, real estate, and cash. Each of these assets comes with its own level of risk and potential return, but when combined effectively, they can help you manage risk and increase the likelihood of achieving your investment objectives. This blog post will guide you through the key concepts of risk in investing and explain how to build a balanced portfolio that aligns with your goals.

What is Risk in Investing?

Risk in investing comes in several forms:

- Market Risk: The risk that the overall market or a specific sector will decline, affecting the value of your investments.

- Interest Rate Risk: The risk that rising interest rates will negatively affect the value of fixed-income securities (like bonds).

- Inflation Risk: The risk that inflation will erode the purchasing power of your investment returns over time.

- Credit Risk: The risk that a borrower (like a corporation or government entity) will default on their debt obligations.

- Liquidity Risk: The risk that you won’t be able to sell an asset quickly without taking a loss.

- Currency Risk: The risk that changes in currency exchange rates will impact the value of foreign investments.

Understanding these types of risk is crucial because it enables you to identify the potential pitfalls of various investments and helps you design a portfolio that minimizes undesirable risks while optimizing returns.

Why is Risk Management Important?

Managing risk is critical to achieving long-term financial success. Many new investors make the mistake of focusing solely on the potential for high returns without considering the associated risks. However, excessive risk-taking can lead to significant losses, while overly conservative strategies may fail to deliver the returns needed to meet financial goals.

By managing risk effectively, you protect your portfolio from major downturns and enhance its potential to generate steady returns over time. In essence, good risk management helps you sleep better at night, knowing that your investments are aligned with your risk tolerance and financial goals.

The Importance of Diversification in Risk Management

One of the best ways to manage risk is through diversification. Diversification is the strategy of spreading your investments across different asset classes, industries, and geographical regions to reduce exposure to any single source of risk.

For example, if you invest all your money in one stock, your portfolio is highly vulnerable to the performance of that single company. If the company faces difficulties, your entire investment could suffer. However, if you diversify your investments across a range of stocks, bonds, real estate, and other assets, the performance of one investment is less likely to significantly affect your overall portfolio.Diversification helps to smooth out the ups and downs of the market, reducing the overall risk of your portfolio. While diversification does not guarantee profits or prevent losses, it is a key principle of sound investing that helps reduce volatility and increase the probability of achieving your financial goals.

How to Build a Balanced Portfolio

A balanced portfolio is designed to achieve an optimal mix of risk and reward by incorporating a variety of assets. The key to building a balanced portfolio lies in understanding your risk tolerance and your investment goals. Let’s break down the process of constructing a balanced portfolio:

1. Assess Your Risk Tolerance

Your risk tolerance is the level of risk you are comfortable taking with your investments. It depends on factors such as your age, financial goals, income, and personal preferences. There are generally three categories of risk tolerance:

- Conservative: If you are risk-averse and prefer to avoid significant fluctuations in your portfolio value, you may have a conservative risk tolerance. A conservative portfolio typically has a higher proportion of bonds and cash investments.

- Moderate: Investors with a moderate risk tolerance are willing to accept some level of risk in exchange for higher potential returns. A moderate portfolio may have a mix of stocks and bonds.

- Aggressive: If you are willing to take on more risk for the possibility of higher returns, you may have an aggressive risk tolerance. An aggressive portfolio typically includes a higher proportion of stocks, with a small portion in safer assets like bonds.

Understanding your risk tolerance helps determine the appropriate mix of assets for your portfolio. A portfolio that aligns with your risk tolerance will be better suited to your emotional comfort, allowing you to stay the course during market fluctuations.

2. Define Your Investment Goals

Your investment goals should dictate your portfolio construction. Consider the following questions:

- What is your time horizon? Are you investing for a short-term goal (e.g., buying a house) or a long-term goal (e.g., retirement)?

- What is the amount of risk you’re willing to take to achieve your goals?

- What are your liquidity needs? Will you need access to your investments in the near future, or can you afford to let them grow over time?

Your goals will impact how much risk you are willing to take and which asset classes will be included in your portfolio. For example, if you are saving for retirement in 30 years, you may be able to take on more risk (in the form of stocks) because you have a long time horizon to recover from potential losses. Conversely, if you are saving for a down payment on a house in the next few years, you may prioritize more stable investments like bonds or cash.

3. Choose the Right Asset Allocation

Asset allocation refers to the distribution of your investments across different asset classes, such as stocks, bonds, real estate, and cash. The goal of asset allocation is to create a mix of investments that balances risk and reward based on your risk tolerance, time horizon, and financial goals.

- Stocks: Stocks are generally considered riskier but offer higher potential returns. They are ideal for long-term investors with a higher risk tolerance. You may consider investing in individual stocks or exchange-traded funds (ETFs) that track stock indices.

- Bonds: Bonds are typically less risky than stocks and provide steady income. They are often used in more conservative portfolios to reduce risk and provide stability. Government bonds, corporate bonds, and municipal bonds are common options.

- Real Estate: Real estate can provide diversification and a hedge against inflation. Real estate investments can include physical properties or real estate investment trusts (REITs).

- Cash and Cash Equivalents: Cash investments, such as savings accounts and certificates of deposit (CDs), are low-risk but also low-return. They provide liquidity and stability to a portfolio, making them suitable for conservative investors.

A well-balanced portfolio might include a combination of these asset classes. For example, a typical moderate portfolio might have 60% stocks and 40% bonds. An aggressive portfolio may have a higher percentage of stocks (e.g., 80% stocks and 20% bonds), while a conservative portfolio may have a higher percentage of bonds (e.g., 40% stocks and 60% bonds).

4. Rebalance Your Portfolio Regularly

Over time, the performance of different assets will cause your portfolio to drift from its target allocation. For example, if stocks perform well, they may make up a larger portion of your portfolio than originally intended, increasing your exposure to market risk. To maintain your desired level of risk, it’s important to rebalance your portfolio periodically.

Rebalancing ensures that your portfolio remains aligned with your risk tolerance and investment goals, helping you stay on track to achieve long-term success.

Conclusion

Understanding risk and learning how to manage it is one of the most important steps in becoming a successful investor. Building a balanced portfolio requires thoughtful consideration of your risk tolerance, financial goals, and time horizon. By diversifying your investments across different asset classes and regularly rebalancing your portfolio, you can mitigate risk while maximizing your potential for long-term growth.

Remember, investing is a marathon, not a sprint. A well-balanced portfolio is a powerful tool that helps you stay focused on your financial goals, weather market fluctuations, and achieve the financial security you desire. With time, discipline, and a strategic approach to risk management, you can build a portfolio that works for you—helping you take control of your financial future.

Post a Comment